Built for the Way You Do Business

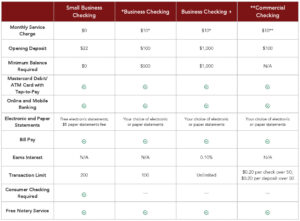

No two businesses are alike–compare our business checking options

to find one that flexes with your needs, no matter the size or

speed of your operation.

*monthly service charge waived if minimum balance is maintained; **an earnings credit calculation is done each month on the average collected balance. This calculation gives your account credit for deposits made to your account and can offset your monthly service charge.

If you’re not sure which account(s) you currently have or would like to switch accounts, please visit your local branch or call us at (888) 325-7777.